EQ Projections

Understanding the different potential pathways that the economy may follow is becoming increasingly vital for businesses as they develop their strategies and plans.

While it is impossible to predict the future with complete certainty, our established analytical framework, combined with extensive experience in forecasting and projection, offers executives a dependable benchmark. This approach is designed to support organisational leadership throughout periods of economic transformation, ensuring decision-makers have the clarity and confidence required to navigate evolving market conditions.

Australian Economic Outlook 2026

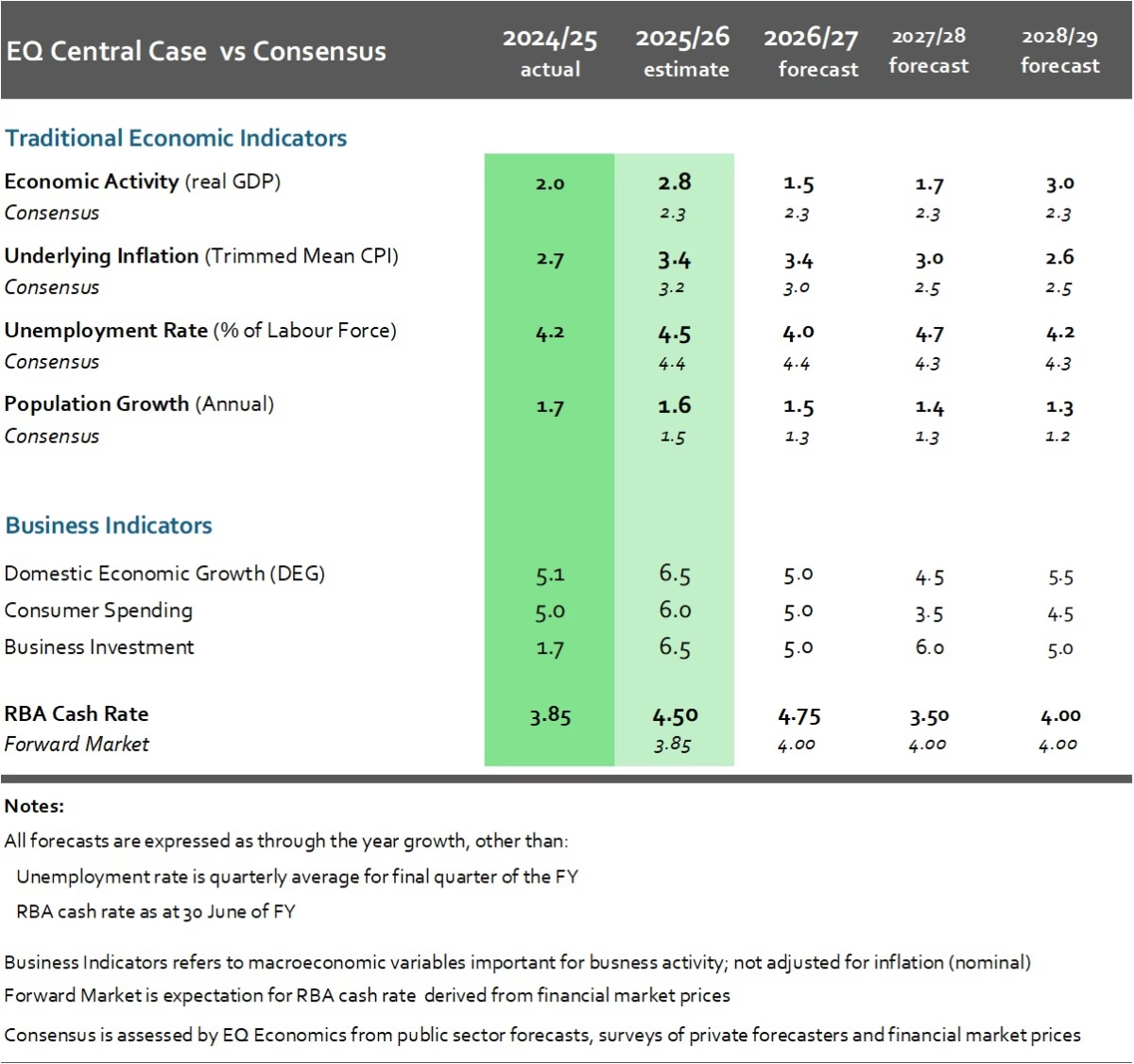

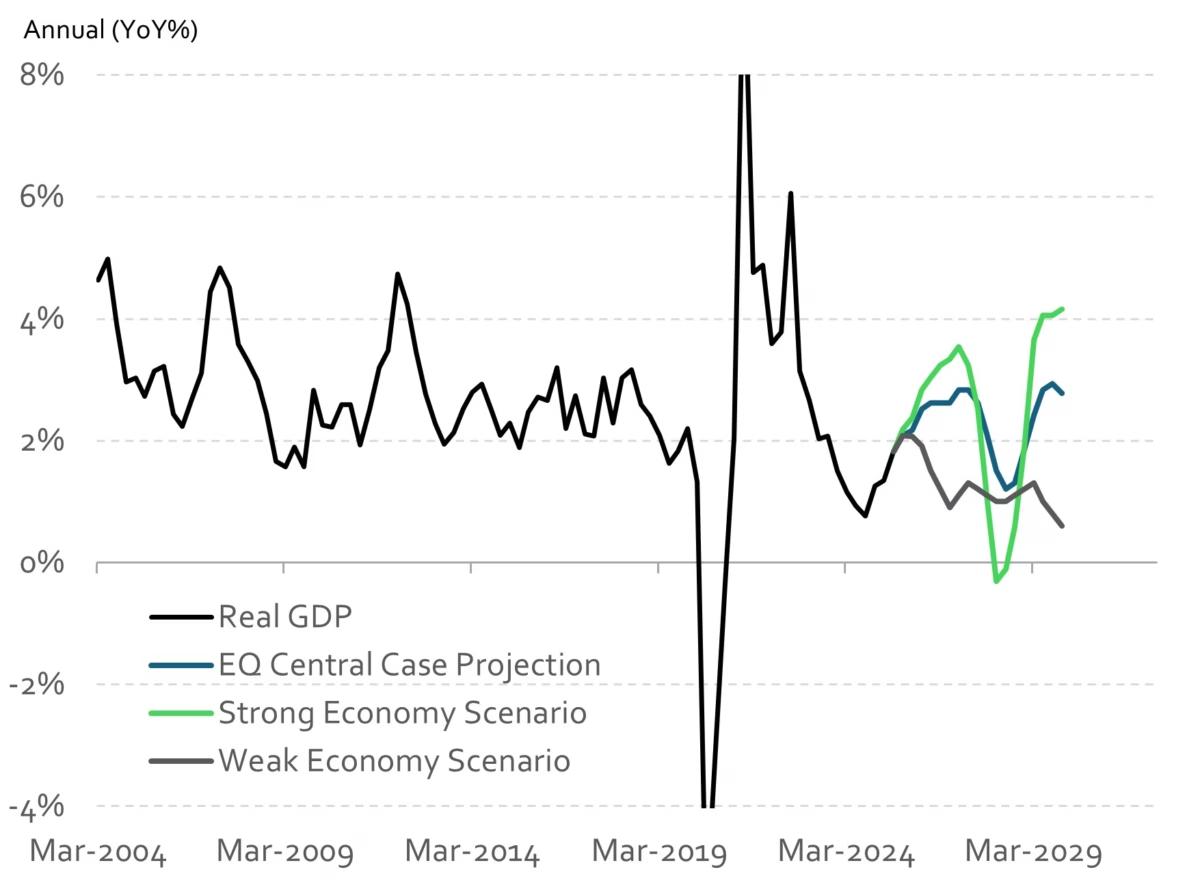

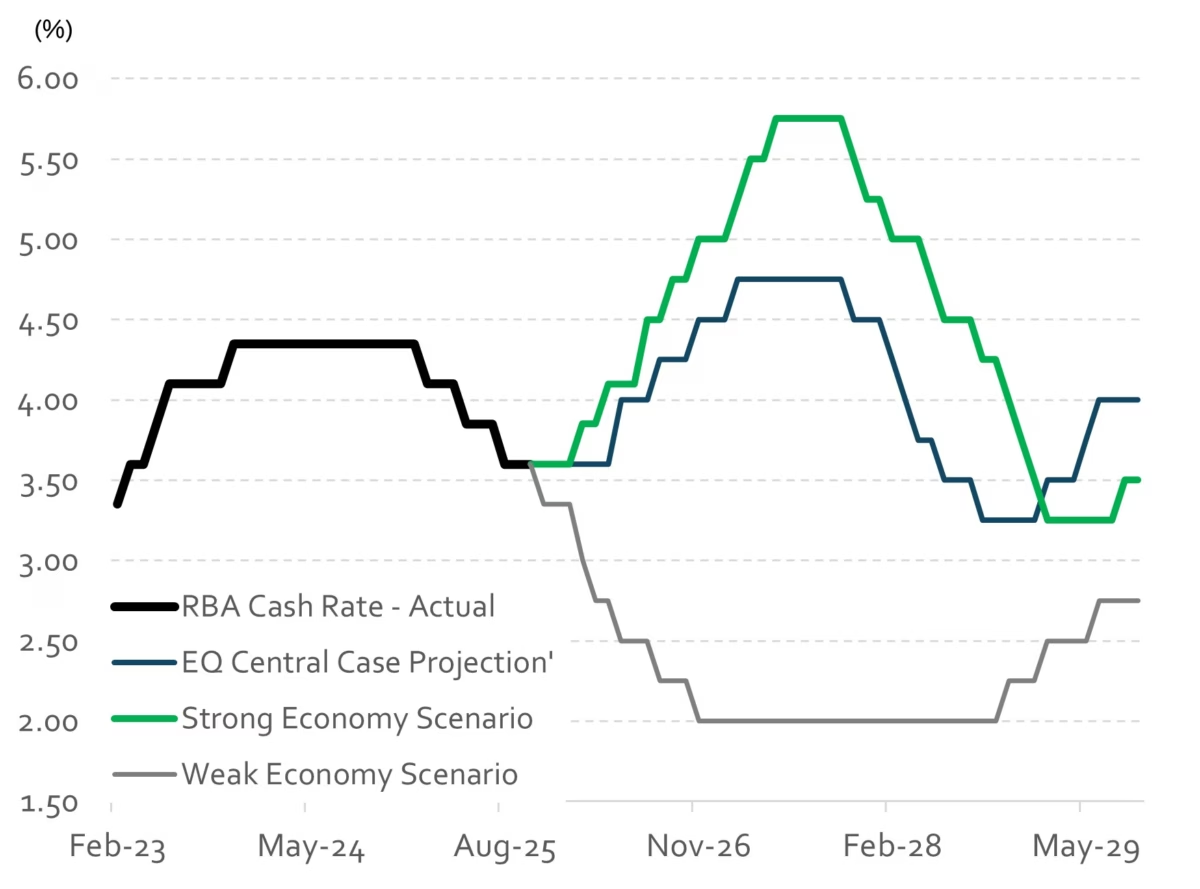

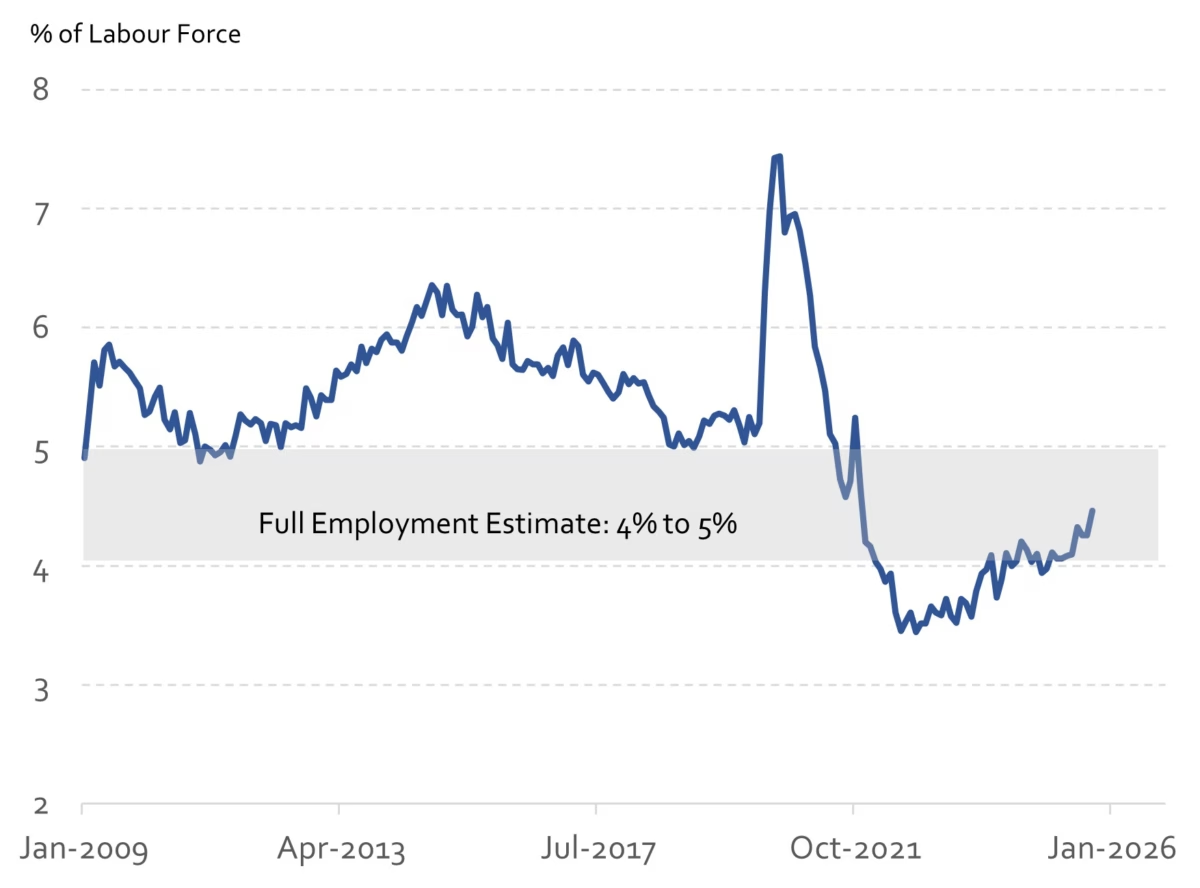

- The run of data over the final months of 2025 confirms our expectations for an economic recovery over the next two years, anchored by solid consumer spending and rising business investment. This is happening quicker than we thought previously which suggests the RBA will need to lift the interest rate sooner than previously expected given evidence of rising inflation. We now expect the first increase in this tightening cycle to happen in February 2026, with the the cash rate rising to 4.50% by the middle of 2026. We have factored in a slowdown in state and federal government spending as per current budget plans. Our assessment is that the economy has little readily accessible spare capacity.

- We are preparing for a situation where domestic demand outpaces the supply capacity of the economy for most of 2026. This highlights why government spending restraint is so important. Growth in government spending above the overall rate of economic growth will accentuate supply constraints and add to inflation pressures, which are building once again. This could result in a more inflation in 2026 and force the RBA into taking the cash rate above the previous post pandemic peak of 4.35%.

- The Consensus view is more benign with a gradual economic recovery that does not press up against the economies supply capacity in a sustained way. As such, the consensus view expects to see inflation return to the RBA’s 2% to 3% target band, potentially with a small increase in interest rates in 2026. The run of data since the beginning of October has not only ruled out further rate cuts, but shows the RBA may need to act early and ecisively to keep inflation under control. There is a real risk interest rate hikes will extend right through 2026 and into 2027.

- The consensus view is constructed by EQ Economics from a range of sources including official forecasts, surveys of private sector forecasters and financial market prices.

Australian Economic Projections 2025 to 2029

EQ Central Case: Recovery Continues

The EQ Central Case projection is a fundamentally positive view of the Australian economic outlook. Economic growth is anticipated to be around 2.5% over the next 2 years (FY26 and FY27) underpinned by a renewed lift in business investment and rising private sector employment. Productivity growth is anticipated to rise. Consumer spending is expected to anchor the expansion of economic activity, supported by continued population growth and higher wages growth. But consumer spending will not be strong by historical standards with balance sheet pressures and elevated interest rates keeping the Aussie consumer in check.

The sting in the tail of a continued economic recovery is the potential for higher inflation and interest rates. Australian households are highly exposed to higher inflation through both higher interest rates and a higher income tax burden. The extent to which inflation and interest rates rise is a critical uncertainty clouding the next 3 years. The widespread pressure being placed on the RBA to keep interest rates low is now entering a dangerous phase. Rising inflation must be taken seriously, and the earlier it is addressed, the greater the chance Australia has of avoiding a disruptive economic downturn in the future.

EQ Strong Economy Projection: Inflation Resurgence

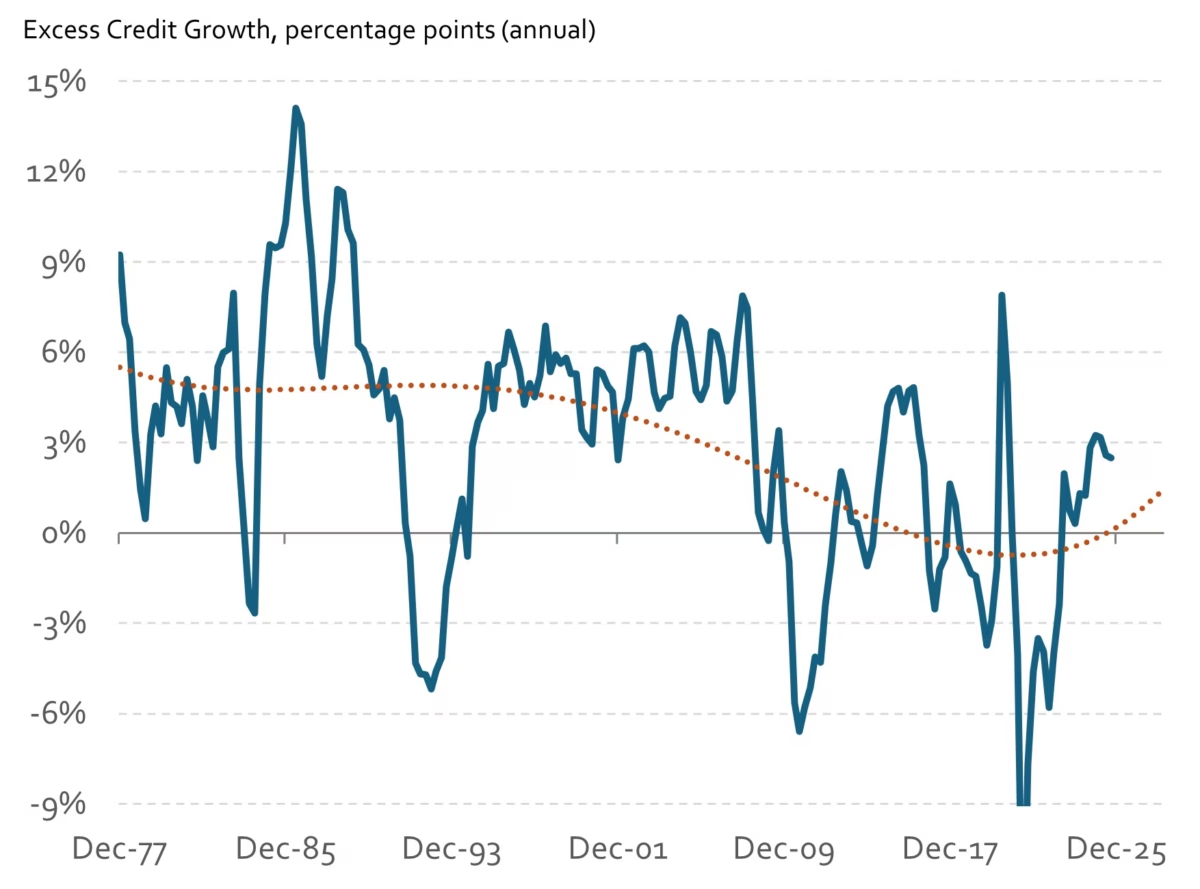

The strong scenario has a much bigger lift in demand in FY26 than the central case. This does not translate into higher real economic output; it largely shows up as higher inflation given capacity constraints, particularly in the labour market. In this scenario wage costs rise strongly over the next two years, particularly for skills in high demand. The RBA responds to rising demand and inflation in 2026 with a series of rate hikes that fails to slow the economy in a meaningful way; inflation persists and ultimately the RBA cash rate rises to a point that triggers financial distress and an economic recession. A key factor to watch in this scenario is credit growth, property prices and wealth effects. Our measure of ‘excess credit growth’, which is essentially the rate of bank credit growth over and above nominal economic growth, provides an indication of the extent of asset price inflation, wealth effects and the financial vulnerability of the economy to higher interest rates. We anticipated a strong and sustained recovery from the projected recession in this scenario. A recovery that is sustained well into the 2030s.

EQ Weak Economy Projection: Weak Private Sector Growth

Despite some recent relief, persistent cost pressures on business cannot be passed onto final prices. Business margins are squeezed throughout 2026. Falling business profitability translates into weaker domestic demand as investment is pared back; business failures and unemployment rise. Government spending lifts to take up the slack. We start down the ‘Japan Route’ with an economy lacking dynamism and dominated by government spending. Productivity growth is weak, real incomes are flat. Government deficits swell, net debt rises. Interest rates come down to around 2% over the next 18 months.

Secular Forces, Megatrends and the Global Economy

Three ‘Secular Buckets’

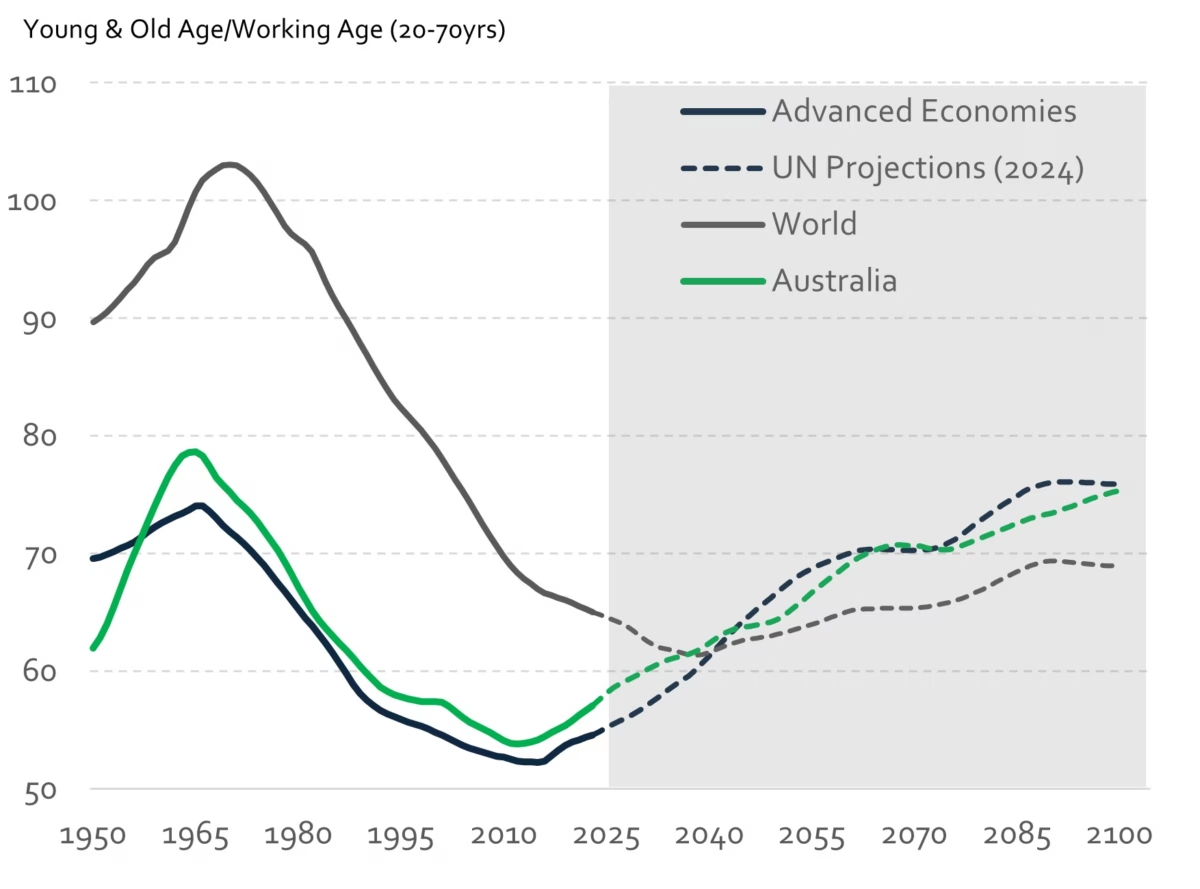

Demographics: we have passed through a long-term turning point in the dependency cycle. A rapidly ageing population is reshaping societies and economies in unforeseen ways. The traditional notion of working age population (16-65 years) is changing with a big rise in the economic impact of those in the 66 to 80 year old cohort, both through higher labour force participation as well as through more economic engagement. The first ‘baby boomer’ turns 80 years old in 2026, a major demographic event across the world.

The most profound economic impact from this demographic cycle is a 180-degree shift in the balance of supply and demand within the economy. The world has transitioned from an economy characterised by demand deficiency and unemployed labour, to a world of supply constraints and labour shortages.

Technology: a step change in computing power and artificial intelligence (AI) could be the culmination of the decades long ‘information revolution’. The incentive to apply and innovative with these new capabilities is high, given emerging labour shortages and rising labour costs.

Supercomputing and AI are turbocharging the digital world, and destroying information asymmetries across our society and economy. This will have profound and unforeseen impacts on all aspects of social, political and economic life.

The Natural Environment: mitigation remain a priority for political leaders while the broader community continues to adapt to new realities

The ‘costs’ of not putting a price on the natural environment are coming home to roost. Climate change is the clear and present danger although it remains unclear how this threat will manifest. Natural resources will be more expensive in the future, increasing costs across the economy including insurance and construction

EQ Economics Long-Term Scenarios for the Australian Economy

LT Central Case scenario reflects the most likely outcome that assumes the size of government stabilises, business investment in new technology and skills increases but the full benefits of technology adoption are not realised as a highly regulated industrial relations system and the already large size of government acts as a headwind to realising the full potential of the new supercomputing and AI age. This scenario factors in a return to centrist economic policymaking in Australia in the 2020s. We do not experience a major energy supply or geopolitical disruption in this scenario.

LT Revitalisation scenario foresees a more volatile economy, but one which delivers a bigger technology impact through higher productivity growth, partly the result of a reorientation of scare labour resources, and partly the result of strong business investment in new capabilities and workforce skills. This scenario factors in a major political and economic policy shift in the 2020s. We do not experience a major energy supply or geopolitical disruption in this scenario.

LT Stuck Scenario reflects a growing government sector, increasing regulation and weak business investment, particularly among smaller and medium sized businesses. This is a similar path that defined the Japanese economy over the last 25 years. The Australian economy lacks dynamism resulting in a persistently poor productivity performance, largely the result of low labour and capital turnover. This scenario factors in a continuation of recent economic policymaking trends in Australia, a weaken industrial infrastructure and ongoing geopolitical disturbance in a range of arenas, including trade and capital flows.

Governance, Policy and Politics

Political and business leaders can play a critical role in supporting the community through this period of change. Long-term assessment and policy thinking can help our community transition to these new demographic and technological realities. Policymakers should be helping all of us to manage risks while supporting those most impacted by change.

Representative democracy has been compromised by the information revolution, with the rise of short-termism, fear mongering and divisive politics across the world. Representative democracy is in functional decline as voters disperse away from traditional party platforms.

Authoritarian regimes are threatening democracies in the most serious way since the 1930s.